ANALYSIS

HOW ARE PALM OILBUYERS PERFORMING?

Palm oil buyers continue to fall short of implementing the necessary transformative actions needed to halt the destruction of the world's most crucial forests and natural ecosystems. Despite efforts, companies are only averaging a score of 14.7 points out of 24. This score underscores the significant distance that remains for these companies to demonstrate a genuine commitment to establishing palm oil supply chains that are devoid of deforestation, ecosystem conversion, and human rights abuses.

- While some companies exhibit leadership in sustainability, the overall pace of action within the industry remains slow, hindering efforts to counteract the ongoing damage caused by unsustainable palm oil production. Additionally, a considerable number of companies refrain from disclosing information about their palm oil usage and sustainability efforts, which limits transparency and accountability in the sector. This highlights the need for greater collaboration and transparency to address sustainability challenges effectively.

- The urgency for action within the palm oil industry has never been greater. Unsustainable practices have fueled biodiversity loss, deforestation, and climate change crises. With ambitious targets and pathways for conserving and restoring biodiversity over the next decade and beyond, there's a clear mandate for accelerated corporate action. Palm oil buyers must translate promises into tangible measures to address these pressing issues. Time is of the essence, and the planet cannot afford further delays.

285

COMPANIES APPROACHEDto participate in the 2024palm oil buyers scorecard

OUT OF 24 WAS THE AVERAGE SCORE

How companies are performing ON FUNDAMENTAL ACTION AREAS

In light of the urgent global crisis, WWF's 2024 scorecard evaluated palm oil buyers against a rigorous set of criteria.

The results are indisputable: while a few have shown praiseworthy strides in removing deforestation, conversion, and human rights violations from their supply chains, there's ample room for improvement among palm oil buyers collectively to achieve impactful and swift progress.

Share of respondents in select sectors

who meet key sustainability criteria

Food Manufacturers

- Food manufacturers comprise 53% of the total volume assessed.

- 85% have "no-deforestation" policies, with 49% aligning with AFI standards.

- 93% have publicly committed to procuring 100% RSPO CSPO, with 70% achieving this commitment by 2023 or earlier.

- 41% report some level of traceability in their palm oil supply chain.

Non-Food Manufacturers

- Non-food manufacturers account for 17% of assessed companies.

- 86% have "no deforestation and conversion" policies, and 86% have policy commitments to respect human rights.

- Majority purchase POD (58%), followed by PKO (20%) and CPO (22%).

- 91% have made public commitments to procure 100% RSPO CSPO, but only 32% have achieved this commitment by 2023 or earlier.

- 68% can determine the traceability of their palm oil supply chain.

Retailers

- Retailers make up 32% of all assessed companies.

- Majority use palm oil in their own brand food products (71%).

- 76% of palm products consumed by retailers are CPO, followed by POD at 19% and PKO making up the rest.

- 93% have made public commitments to source 100% RSPO CSPO, with 63% achieving this target by 2023.

- Only 17% can trace a portion of their palm oil back to the plantations.

FEED AND BIOFUEL

- Three respondents primarily use palm oil ingredients for animal feed manufacturing.

- All three companies are RSPO members, but only two made commitments to source 100% RSPO certified palm products, none achieved by 2023.

- None currently have traceability in their palm oil supply chains.

KEY FINDINGS

COMMITMENTS

THERE ARE ENCOURAGING SIGNS THAT MORE COMPANIES ARE ADOPTING ROBUST COMMITMENTS THAT ADDRESS THE ENVIRONMENTAL AND SOCIAL RISKS IN THEIR PALM OIL SUPPLY CHAINS IN AN EFFECTIVE AND TIMELY MANNER

This year's scorecard reveals a notable shift, with a majority of companies now adopting no-deforestation and conversion commitments along with comprehensive human rights commitments. This response aligns with calls from WWF and broader civil society for companies to embrace the core principles of the Accountability Framework. These principles urge companies to elevate their commitments by publicly declaring clear targets and time-bound milestones that reflect the urgency of the ecological crisis we face.

The majority of respondents who have pledged to address deforestation, conversion, and human rights apply these commitments universally across their entire operations and all types of palm oil.

A notable 91% of respondents have committed to sourcing 100% RSPO CSPO. However, within this group, 24% have set a post-2023 implementation target, while 13% lack a specific timeframe.

Following the guidance provided in the Accountability Framework, palm oil buyers are encouraged to supplement their deforestation-free pledge with a commitment to avoiding conversion, thereby safeguarding diverse natural ecosystems beyond forests. These ecosystems play a crucial role in carbon sequestration, biodiversity preservation, water resource maintenance, disaster risk reduction, climate change adaptation, and the welfare of local communities. Moreover, the disparity in commitment levels demonstrates a need for clearer timelines and strategic planning to ensure the effective realisation of sustainable sourcing goals.

respondents

respondents

respondents

Purchasing sustainable palm oilS

SOURCING 100% RSPO-CERTIFIED PALM OIL IS STILL NOT THE NORM.

Of the 10.1 million MT of palm oil derived ingredients reported by respondents in this year’s scorecard, only 59% is certified. Palm oil buyers must swiftly boost their sourcing of certified sustainable palm oil in all markets and bridge the certification gap. They should also take proactive steps and be transparent about barriers to wider adoption of certified supply.

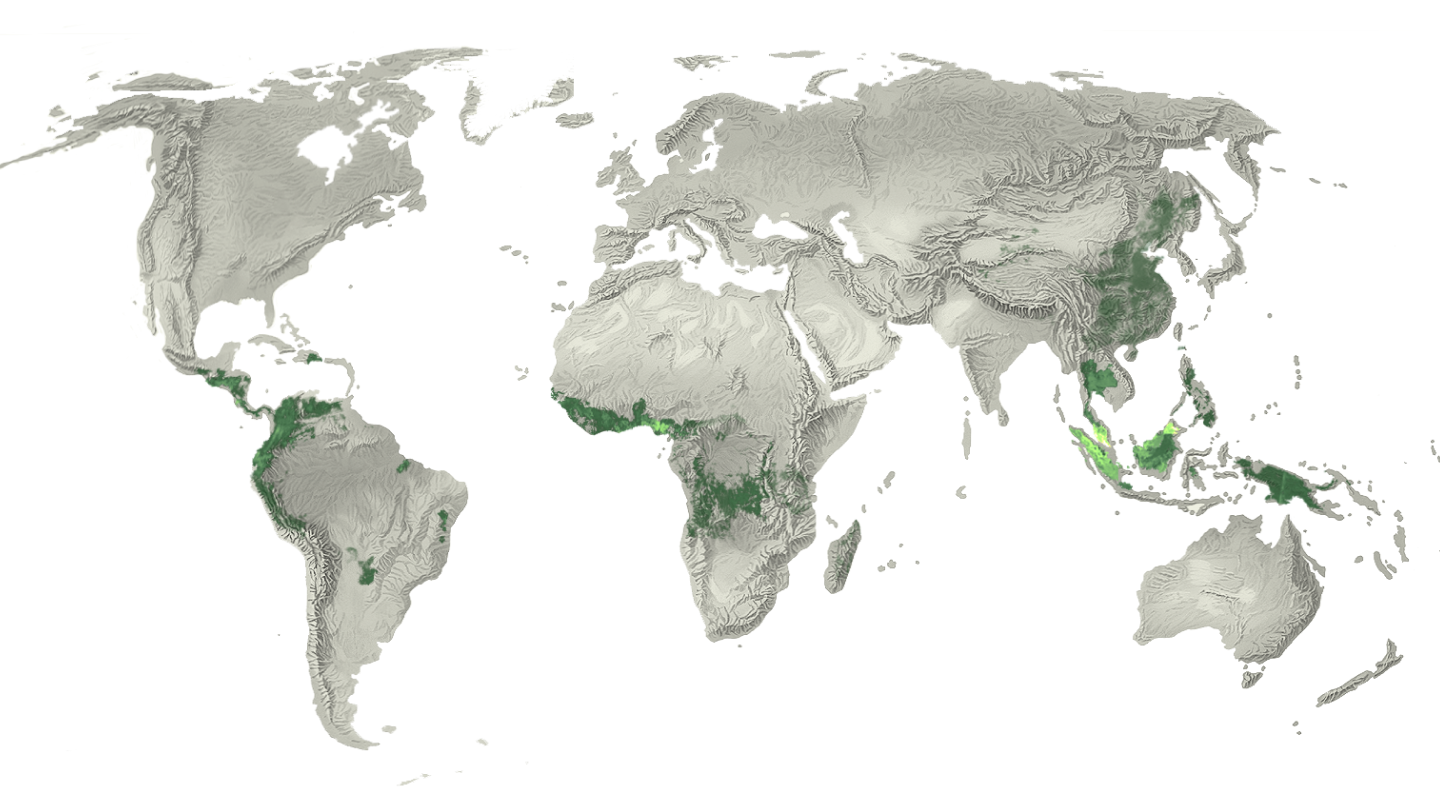

North America, Europe and UK-based respondents have the highest uptake of RSPO CSPO. Conversely, respondents from Asia and Africa lag behind, indicating the need for significant progress in narrowing the certification gap in these regions.

- 2,082,109Total RSPO CSPO volume

- 92.7%RSPO CSPO uptake

- 7.4%SG/IP/IS

- 56.6%MB

- 28.7%B&C

- 3,864,238Total RSPO CSPO volume

- 51.4%RSPO CSPO uptake

- 19.8%SG/IP/IS

- 25.2%MB

- 6.4%B&C

- 354Total RSPO CSPO volume

- 12.8%RSPO CSPO uptake

- 0%SG/IP/IS

- 12.8%MB

- 0%B&C

- 178,282Total RSPO CSPO volume

- 32.6%RSPO CSPO uptake

- 10.5%SG/IP/IS

- 10.4%MB

- 11.7%B&C

Despite sourcing sustainable palm oil, companies continue to heavily rely on supply chain options that do not offer the most robust environmental and social safeguards, presenting a stark deficiency in their commitment to sustainability.

Sourcing RSPO-certified palm oil through Segregated or Identity Preserved options, the only two supply chain options that offer transparent tracing to sustainable sources, remains limited.

Mass Balance and Book & Claim credits as the preferred model is a cause for concern as it doesn't fully eliminate environmental and social risks due to mixing certified and uncertified sources. Moreover, these two supply chain options don't preserve traceability data, making them non-compliant with the EU Regulation on Deforestation-free products, which requires such data for verifying zero deforestation commitments.

The RSPO impact report for 2023 shows that more Mass Balance (MB) mills have been established than Identity Preserved (IP) mills adding to the current limitation.

are sourcing 100%

Identity Preserved or Segregated palm oil

of certified volumes reported by scorecard respondents

are from palm oil certified as Segregated or Identity Preserved (which is half the share of mass balance)

supplier accountability

Companies are enhancing sustainability commitments by extending them to include suppliers and ensuring accountability.

As companies increasingly align with the Accountability Framework's Core Principles, they expect their suppliers to match the same level of robustness in environmental and social commitments.

As companies increasingly align with the Accountability Framework's Core Principles, they expect their suppliers to match the same level of robustness in environmental and social commitments.

Palm oil buyers should establish robust monitoring, verification and reporting systems using the Accountability Framework as a common reference. They should also engage their suppliers more comprehensively by requesting and incentivising suppliers to be sustainable across all of their operations

respondents

Sustainability platforms

Reporting traceability levels upstream of the value chain is slowly gaining traction

Reporting traceability levels upstream in the value chain is increasing, even for volumes and production landscapes not fully certified, thanks to ongoing engagement efforts by civil society groups.

Companies are investing in traceability to comply with evolving regulatory frameworks like the EUDR and mitigate legal risks. While traceability doesn't ensure palm oil sustainability alone, it helps companies identify and address social and environmental risks in their supply chain more effectively. Palm oil buyers wield significant influence to ensure collaborative implementation of traceability mechanisms and reporting with their suppliers.

SUSTAINABILITY PLATFORMS

Promisingly, most palm oil buyers are engaging in collective action and advocacy efforts through initiatives and platforms to address deforestation, ecosystem conversion, human rights concerns, and broader sustainability challenges across the palm oil supply chain.

Achieving profound transformation in the industry requires a united front through collective action and relentless advocacy. A majority of respondents are taking part in action-oriented sustainability platforms. Large-scale transformation in the palm oil industry necessitates collective action and advocacy. Palm oil buyers must collaborate to address the systemic sustainability challenges inherent in conventional palm oil production.

95% of

respondents

However, only 8% of the respondents scored full points on RSPO’s shared responsibility scorecard.

REPORT BEING MEMBERS OF THE RSPO, ACTIVELY CONTRIBUTING TO THE PLATFORM’S MISSION TO MAKE SUSTAINABLE PALM OIL.

ON THE GROUND ACTION

A significant number of companies are expanding their efforts beyond their supply chains

Companies must clean up their supply chains while focusing on fostering inclusive rural economies and protecting natural ecosystems and local community rights. Supporting such initiatives aligns with long-term supply goals and drives tangible on-the-ground impact. From conservation and forest protection projects to smallholder capacity building or jurisdictional/landscape approaches, there is a myriad of investments companies can make to drive positive impact.

The scorecard introduced significant changes this year, emphasising alignment with Accountability Framework Initiative (AFI) Operational Guidance (OG) to ensure companies contribute to broader sustainability goals.

respondents